Over the past month, every facet of our lives has dramatically changed. Shelter-in-place orders, rotating bank staff, lobby closures, government stimulus programs and a myriad of regulatory updates have stretched risk management resources. TCA has received many questions from clients asking for our interpretation of guidance that has been issued in response to these regulatory communications and as your compliance partner we have written this article to help bring some clarity to this information.

FinCEN March 16, 2020 Press Release

FinCEN provided contact information for its Regulatory Support Section (RSS) for institutions to contact if they expected to experience delays in filing currency transaction and suspicious activity reports as a result of the pandemic: phone number 800-949-2732 or email FRC@fincen.gov. A third option to contact FinCEN is its website: https://www.fincen.gov/contact. For inquiries relating to COVID-19, select the appropriate option from the drop-down menu. Institutions experiencing compliance challenges should also contact their primary regulator.

If you contact FinCEN and your regulator, TCA recommends maintaining supporting documentation for all communications. These will be needed as part of future independent reviews and exams if reports were filed outside of the regulatory recommended timeframes.

COVID-19 Related Scams

FinCEN also shared information regarding emerging trends in scams and consumer fraud related to the pandemic.

- Impostor Scams – Scam artists may use phone or email posing as charitable organizations to solicit donations, steal personal information or distribute malware. New account staff should continue to perform due diligence for non-government organizations to ensure that they have authorization to use names for which they are titling an account. When monitoring distributions for non-government organizations (NGOs), BSA staff should determine if the destination of funds is reasonable based on the expected activity for the account and ask questions if funds appear to be used for the benefit of the account signers rather than for the benefit of the charity.

- Investment Scams – Businesses may make false claims about the ability of products or services to prevent, detect or cure coronavirus. These claims could be a front for a Ponzi scheme to defraud investors. Suspicious activity red flags for Ponzi Schemes include large even-dollar-amount checks being deposited into an account followed by an absence of legitimate business expenses. The account signers may use proceeds for personal expenses or lavish activities such as the purchase of luxury cars or jewelry. These may be accompanied by round-dollar-amount checks to early investors to give the appearance of a successful business venture.

- Product Scams – Businesses may make false claims regarding government approval of products having health benefits relating to COVID-19 for the purpose of increasing sales. This type of activity may be more difficult for a financial institution to identify all products sold by the business customer, even if you are able to perform site visits. When performing due diligence on medical companies, consider including a review of the Federal Trade Commission (FTC) as part of negative news searches. The FTC issued press releases on April 14, 2020 and March 9, 2020 listing companies it determined were making false claims relating to COVID-19. The Food and Drug Administration (FDA) keeps a list of warning letters on its website.

- Insider Trading – There were some high-profile cases involving members of Congress engaging in insider trading prior to issuance of travel restrictions and social distancing requirements. As preventative measures continue to evolve, insiders may continue to make illegal trades based on their advance knowledge of events yet to come. We may see unusual ACH and wire transfer transactions from investment companies. We should consider our knowledge of our customer, particularly if we have a politically exposed person (foreign or domestic) or a customer we know to be a major shareholder in a large corporation who has significant transactions involving investments just prior to any major news stories.

FinCEN references the earlier fraud advisory FIN-2017-A007, which provides red flags to help identify fraud patterns. TCA recommends, as a risk manager, that you remind your staff about potential scams and the red flags. Document staff communication to demonstrate the strength of the training pillar for your BSA Program.

If you do file a SAR relating to COVID-19, FinCEN recommends that preparers fill in “COVID19” in Field 2 of the SAR.

Staff should be reminded to verify the source of an email before opening any suspicious attachment or clicking on a link in an email.

Before sending any money to support an unsolicited request for money, contact the charity at a verifiable phone number to ensure the legitimacy of a request.

FinCEN April 3, 2020 Press Release

Currency Transaction Report Update

On February 10, 2020, FinCEN issued FIN-2020-R001 updating the requirements for filing CTRs for sole-proprietors and legal entities. TCA’s Managing Partner, Brian Crow, shared a Training Video describing the new requirements. Because of challenges financial institutions face relating to COVID-19, FinCEN postponed mandatory compliance with this ruling indefinitely. For institutions that have already revised their filing procedures to comply with the ruling, you do not have to revert to the old procedures.

Beneficial Ownership

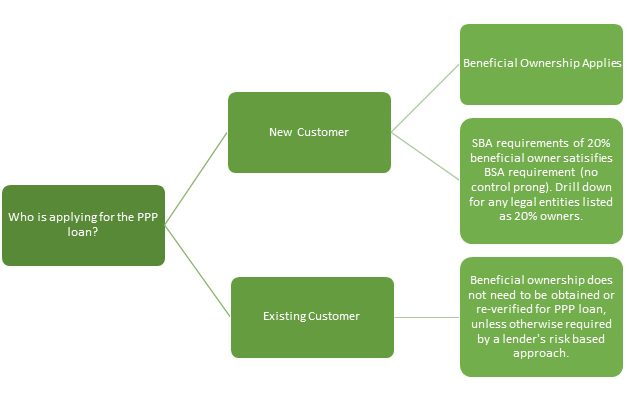

Many TCA clients had questions relating to the collection of beneficial ownership information requests for loan modifications, payment deferrals and Paycheck Protection Program (PPP) applications. The federal government’s goal was to streamline the process for helping distressed businesses as quickly as possible. Consistent with that goal, FinCEN eased the requirements for verifying beneficial ownership for existing customers. The release stated that if an institution’s risk-based approach to BSA compliance required verification of existing customers, the institution should still follow its procedures. If existing procedures are relaxed for CDD on the PPP loans, TCA encourages institutions to add a brief addendum to their customer due diligence procedures stating they will not require reverification for PPP loans. To demonstrate appropriate Board and management oversight, document notification of this decision in the Board minutes of the next scheduled board meeting.

For non-PPP loans, the September 7, 2018 exceptive relief does not require the collection of beneficial ownership information for loan renewals, modifications, restructuring or extensions that do not require underwriting. For loans that do require underwriting to make decisions for granting relief to the borrower, FinCEN stated that delays in collecting beneficial ownership information would be acceptable but noted that the requirements would not be eliminated.

SBA Paycheck Protection Program Loans FAQs

Treasury issued frequently asked questions (FAQs) to assist lenders in administering the program. Although most of the questions related to underwriting and loan documentation requirements, FAQ #18 included a question relating to beneficial ownership requirements. In addition to waiving reverification of beneficial ownership for existing customers, the SBA FAQs took the discussion one step further, stating that institutions were not required to obtain beneficial ownership information for existing customers for whom it had not previously obtained certifications.

This document resulted in a large volume of questions from the financial industry as it now had conflicting guidance from two different federal government agencies. On one hand, BSA beneficial ownership requirements are to collect information at a 25% ownership level and require the beneficial owner’s date of birth. The SBA PPP loan application requires the collection of ownership information at a 20% ownership threshold and the application does not include a space to collect a birthdate. None of the guidance addressed financial institutions that require the beneficial ownership requirements when a deposit account is required as a condition of securing a PPP Loan. The additional guidance on April 13 attempts to clarify questions raised in these initial FAQs as shown below.

FinCEN PPP FAQs April 13, 2020

On April 13, 2020 FinCEN published another set of FAQs which mirrored FAQ #25 which was added to the SBA document. FinCEN aligned its position with the SBA, allowing the waiver of the collection of beneficial ownership certifications for all existing customers applying for PPP loans even if the institution had not previously collected the information. FinCEN also stated that it would accept the collection of ownership information at the 20% level as satisfying the requirements to comply with the beneficial ownership rule. FinCEN did remind institutions that if another legal entity is listed on SBA application, the institution must still “drill down” to determine whether any natural persons own more than 20% of the customer when determining who the beneficial owners are for that customer.

In all the documents referenced here, there is still no mention of deposit accounts. For those institutions that require the establishment of a deposit account to obtain a PPP loan, TCA recommends obtaining beneficial ownership certifications and verifications consistent with established procedures, as these special processes have not been extended to deposit accounts.

As of the date of this publication, the Treasury advised that the appropriated funds for PPP Loans have been exhausted. However, TCA encourages institutions to evaluate their processes that have been utilized while processing applications to ensure it aligns with this information and to document any changes that may have been made to policy and procedure. If Congress appropriates additional funds for PPP loans in the future, this information will be a convenient reference guide to the most current guidance.

Like FinCEN, TCA recognizes we are all living in a dynamic time and that everyone is adjusting for the safety and well-being of employees, their families, and your customers.

As your compliance partner, TCA is here to demonstrate A Better Way for compliance. Contact us at 800-934-7347 or info@tcaregs.com

BSA Requirements & Paycheck Protection Program (PPP) Loans

REMEMBER: If this is not a PPP loan, follow your current beneficial ownership procedures for whether this is a new or existing customer. FinCEN has only created caveats relating to PPP loans.