April 1st is known as April Fools’ day and a time to play tricks and pranks. But did you know on April 1, 1748, the Ruins of Pompeii were rediscovered by Spaniard Rocque Joaquin de Alcubierre? Guess it is time to rediscover the CRA Public File and make sure nothing ancient is inside!

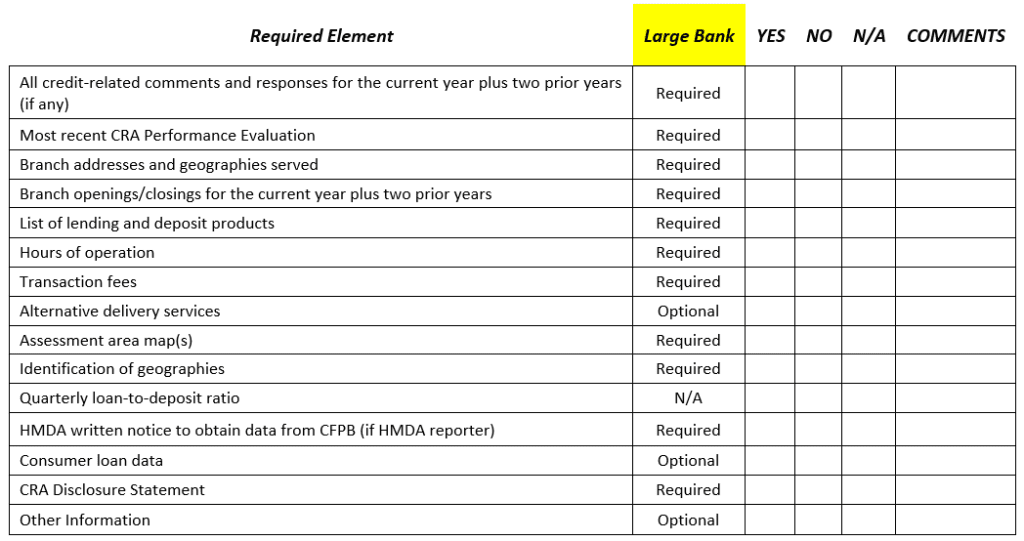

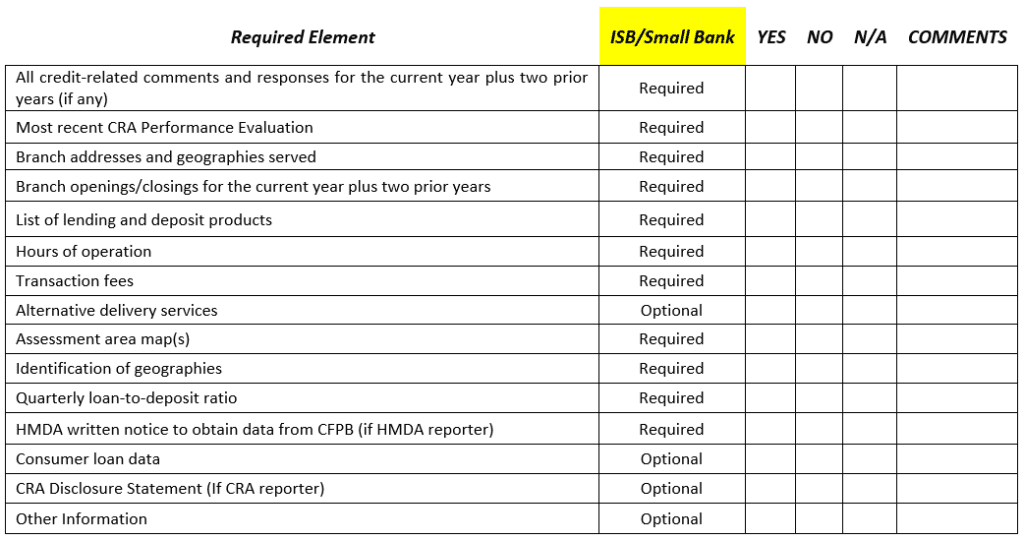

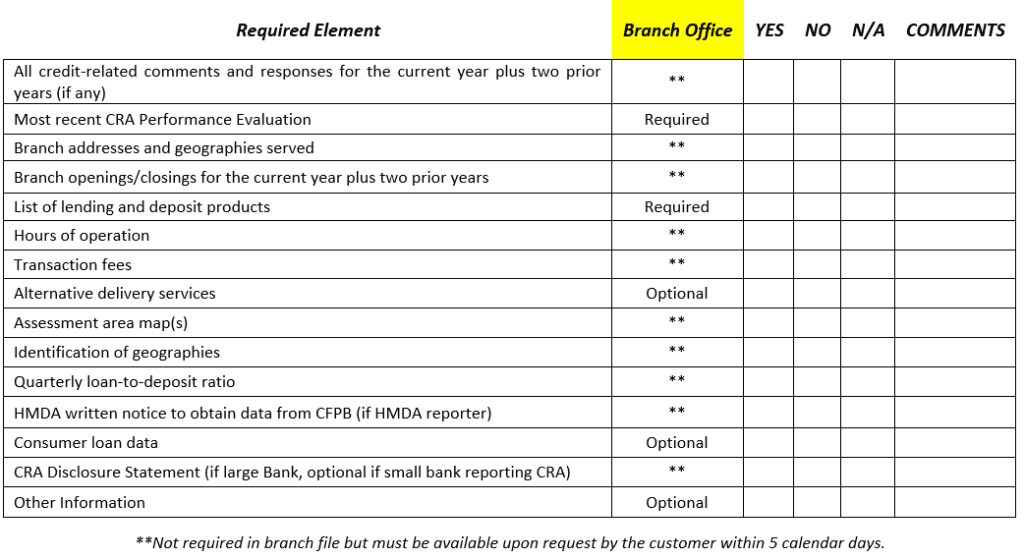

By now everyone has probably obtained or produced a checklist to ensure all items are in the CRA Public File; if not, we have provided a checklist for large bank institutions, intermediate small bank institutions, small bank institutions and requirements for a Branch file at the end of this article for you to use.

The first thing that should be on every compliance person’s calendar is a tickler at least one week (if not more) prior to April 1st as a reminder to start gathering information for the CRA Public File. Some of the gathering of information really should be done throughout the year. Keep a file folder (electronically or paper) of new products, fee changes, notes/cards/emails from customers expressing thanks for any community involvement, along with any complaints and if the bank has expanded into new census tracts with tract listings and updated maps. In doing this you will not have to try and recreate as much as you update the file.

Some things that TCA has noted in past CRA Public File reviews:

- Bank fees for lending transaction not in the file,

- Fees sheet does not match what is provided at account opening or on TISA,

- Hours of operation do not match to what is on the bank’s website,

- Services do not match to what is on the bank’s website,

- Census tract had changes and not updated in file, and

- New assessment area information which has not replaced old documentation.

It is important to review information for accuracy across all facets of the bank: Disclosures, Website, Advertisements, Lobby posters etc. All of them should match.

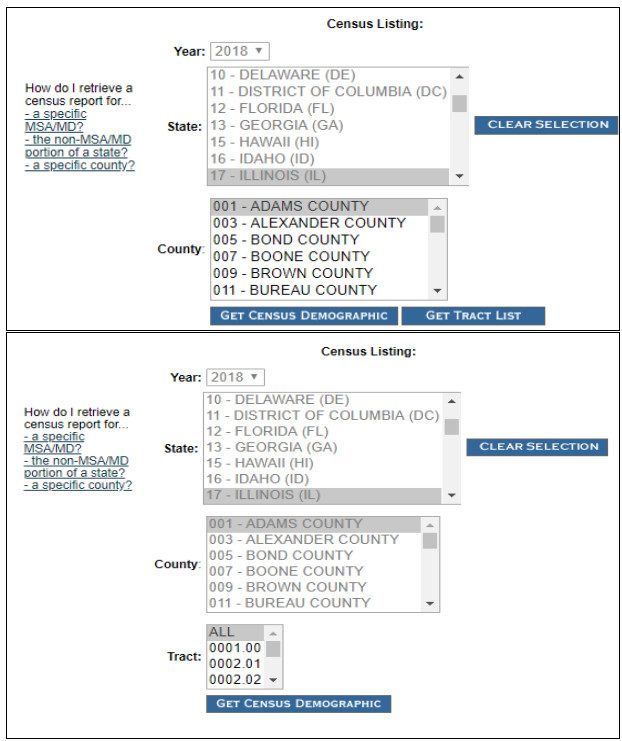

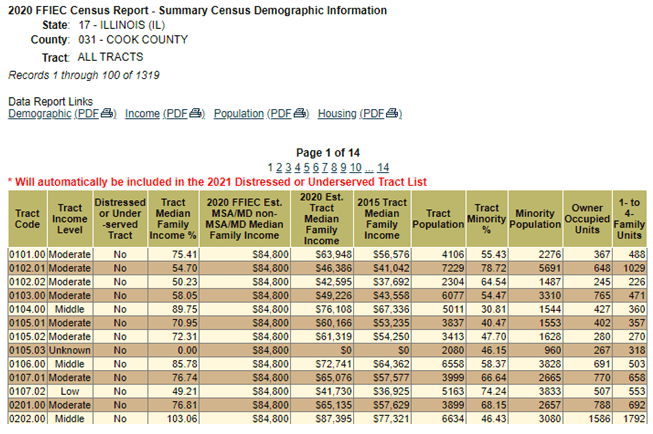

Sometimes, the bank is not aware of census tract changes being made within its assessment area. Due to technology changes, it is very easy to obtain current census tracts for the bank’s area. Below we provided step-by-step instructions on how to obtain your current census tracts.

Using https://www.ffiec.gov

Click on FFIEC Census and Demographic Data

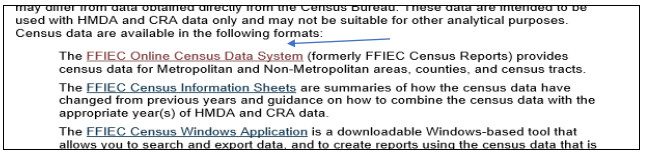

Click on FFIEC Online Census Data System

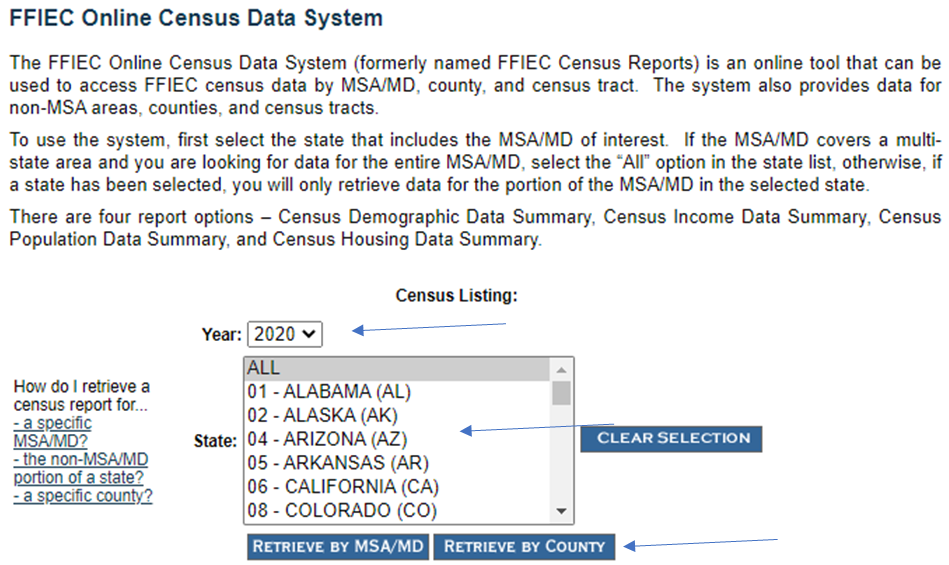

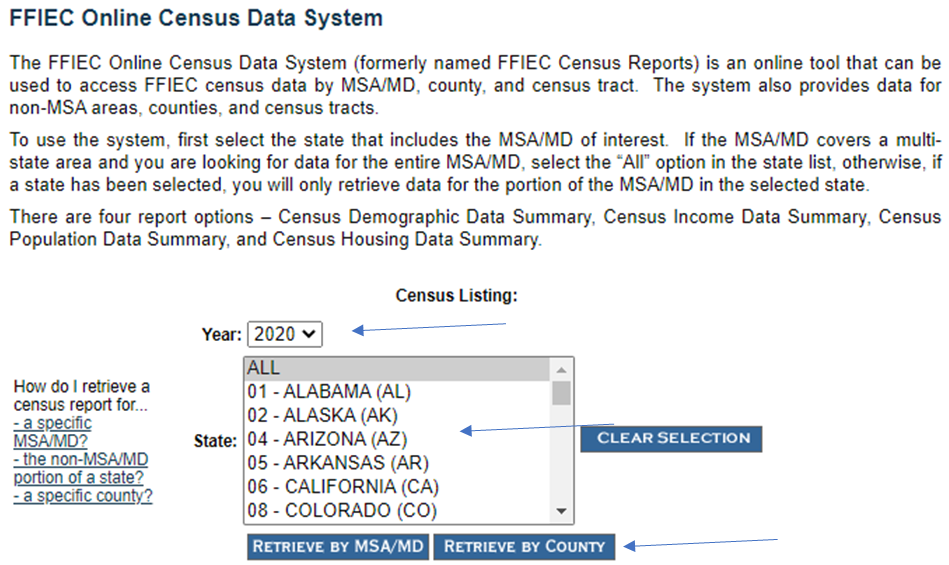

Click on Year and State and then Retrieve by County.

Click on County/City and then click on Get Tract List then select the desired Counties.

Click on Get Census Demographics.

Your CRA public file does not have to be on paper, it can be maintained electronically on the bank’s website. However, if a print copy is requested it must be provided in print.

Below are the checklists for Large Banks, Intermediate-Small Banks (ISB) and Small Banks. ISB and Small Banks utilize the same checklist. In addition, a Branch requirement checklist is included if the financial institution maintains paper CRA Public Files.

Although this seems like a minor task, the required public file information is important and can cause the bank issues with the exam regulators if it is not updated on a timely basis or if information is not correct. TCA encourages you to review your CRA Public File to ensure everything is up to date before April 1st! Please contact TCA if you have any questions or need assistance with complying with the Community Reinvestment Act with understanding lending performance, maps, or community development activities.

TCA – A Better Way!