You must admit, defining what is a business day when it comes to lending regulations can be very confusing. Based on the questions we get from clients during our compliance reviews and through our compliance hotline, we find that lending staff is inconsistent and uncertain on how to count business days versus calendar days when furnishing lending documentation.

First, if the regulation only says days, does it mean calendar or business days? If the regulation is silent, the normal convention is to use calendar days.

Second, there’s confusion on how to define Saturday and Sunday: are they or aren’t they business days? Or, are Monday through Friday only business days? What about holidays? It’s enough to make your head spin!

We typically think of business days as Monday through Friday, but it isn’t quite that simple in the world of lending regulations. This article will walk you through the regulatory definitions and requirements and provide clarification on how to count days when furnishing loan disclosures. So, let’s try to make it a little simpler for you.

Regulation Z defines a business day as “a day on which the creditor’s offices are open to the public for carrying on substantially all of its business functions.“ This is also referred to as a General Business Day. If you are open for substantially all of your business functions on Saturday or Sunday, you would count those days as business days for purposes of when initial mortgage documents must be furnished. “Substantially all business functions” includes availability of personnel to make loan disbursements, to open new accounts and to handle credit transaction inquiries. If your customer service windows are open on Saturday only for limited purposes such as deposits and withdrawals, Saturday would not count. Simple, right? Not so fast!

This rule of thumb doesn’t hold for purposes of the right of rescission and final disclosures for closed-end mortgages. Both of these rules define a business day as all calendar days except Sundays and legal public holidays. This is referred to as a Precise Business Day. So, for Closing Disclosure and Rescission purposes, you always count Saturday but never count Sunday as a business day.

Let’s not forget about holidays! There are 10 legal holidays defined under Regulation Z. They are New Year’s Day, the birthday of Martin Luther King Jr., Washington’s birthday (sometimes referred to as President’s Day), Memorial Day, Independence Day, Labor Day, Columbus Day, Veteran’s Day, Thanksgiving Day, and Christmas Day. When a holiday falls on a Saturday or Sunday and the holiday is observed on Friday or Monday, how is it treated? Is the observed day considered the legal public holiday? The answer is “no.”

Four of the Federal holidays are identified by a specific date: New Year’s Day – January 1; Independence Day – July 4; Veterans Day –November 11; Christmas Day December 25; When these holidays fall on a Saturday or Sunday, the observed days are NOT considered legal public holidays and ARE considered business days.

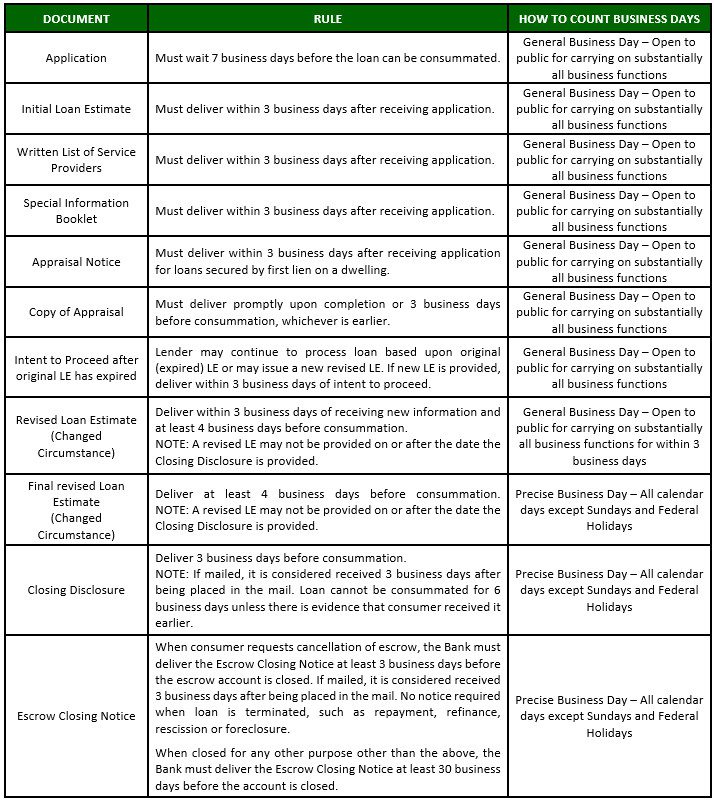

The chart on the following page is designed to help clarify when you may or may not count Saturday and Sunday as business days.

Tips for documenting compliance with the timing rules:

- Ensure procedures include instructions for documenting triggering dates, such as date of application, date consumer receives the Loan Estimate and Closing Disclosure, and date consumer indicates Intent to Proceed with a loan.

- Procedures should be implemented to account for changed circumstance dates and other triggering events.

- Watch the date before charging a customer for the appraisal, flood certification or any services other than the credit report until the Loan Estimate has been received and the consumer indicates Intent to Proceed.

Business Day Reference Chart