Keep up to date with our Regulatory Compliance Manager Subscription Service

If there’s a subject that you’d like to research, please call 800-934-REGS or email us [email protected] and we’ll get the information to you.

Vendor Management – Monitoring Consumer Complaints

Even though a topic may not fall under TCA’s typical umbrella of compliance, we often have broader compliance discussions with our clients that we feel are important to share for informational purposes; this is one of those instances. We were told by a banker that an examiner had cited a deficiency in the institution’s vendor […]

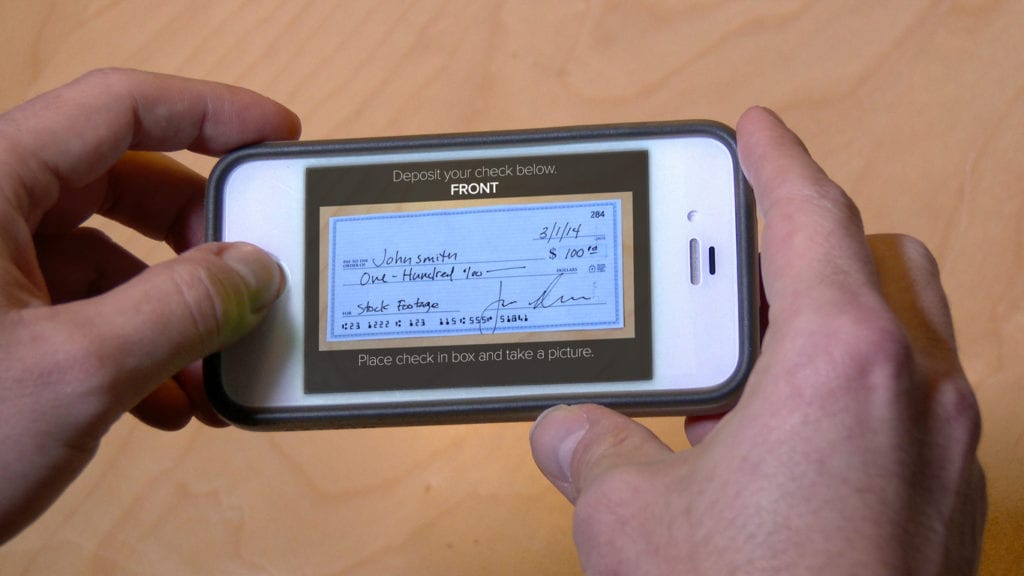

Regulation CC Changes Finalized Eight Years Later

You may recall a 2017 article discussing the long-awaited Regulation CC changes which, after reading, we found out were not the changes compliance professionals were waiting for. Well, wait no longer! Like St. Louis Blues fans, the day you’ve been waiting for has arrived! OK, that’s a lot of excitement for Regulation CC, but it […]

Clarifying the Joint Intent Requirements at Application

Joint intent exceptions are a common finding in our compliance reviews. We have found that there are misconceptions on what constitutes joint intent and how it should be documented; most of the questions come from commercial versus consumer mortgage loan officers. Many of the questions we are asked include: Isn’t the joint financial statement enough […]

What do CDD and EDD Mean? Part II: Enhanced Due Diligence

The expectation for enhanced due diligence did not change with the passing of the 5th BSA pillar. However, examiner expectations for enhanced due diligence (EDD) continue to evolve because it is a critical component of your bank’s BSA Program. TCA® first addressed the EDD topic in a 2015 In Depth article. The November 2018 BAT […]

Maintaining the Legal Entity Identifier (LEI): Should Partially-exempt HMDA Filers Renew?

The passing into law of the Economic Growth, Regulatory Relief, and Consumer Protection Act (EGRRCPA) provided institutions with a partial exemption of some data fields under HMDA. One of the fields in the exemption is the Universal Loan Identifier (ULI) and allows institutions to report a Non-Universal Loan Identifier (NULI). The difference between the two […]

Fair Lending and Marketing in the Digital Age

There’s an old saying, “You don’t know what you don’t know” and that is certainly true when it comes to marketing initiatives meshing with the world of fair lending. The clash of both worlds and the often-divergent priorities have caused regulators to put this intersection under a microscope. A key fact today is that marketing […]

Defining Business Days for Lending

You must admit, defining what is a business day when it comes to lending regulations can be very confusing. Based on the questions we get from clients during our compliance reviews and through our compliance hotline, we find that lending staff is inconsistent and uncertain on how to count business days versus calendar days when […]

Financing Manufactured Homes Without Land

The financing of manufactured homes is a niche market. Not all banks offer this type of financing because of the varying underwriting requirements, risk and limited salability of this type of loan. As a bank begins to investigate manufacturing home lending, it is often focused on prudent underwriting and the safety and soundness for this […]

Accepting Private Flood Insurance Policy – Two Choices

TCA’s February 7, 2019 Special Release “Final Rules Released for Acceptance of Private Flood Insurance” said lenders can accept a private flood insurance policy and easily identify an acceptable policy. The rule suggests private providers add the following “compliance aid” clause: ‘‘This policy meets the definition of private flood insurance contained in 42 U.S.C. 4012a(b)(7) […]

CRA Public File Is No April Fools’ Joke!

April 1st is known as April Fools’ day, a time to play tricks and pranks. Some historians have noted that April Fools’ Day dates to 1582. It is speculated that the start of the new year had moved to January 1st and people who were slow to get the news and/or continued celebrating the new […]